Real agri action needed to check rising inflation

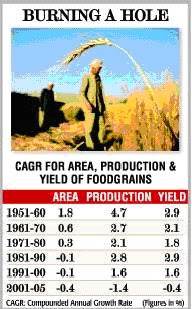

MONETARY and fiscal measures seem to have failed in tempering rising prices as the new headline inflation numbers reveal fresh signs of pressure. The wholesale price index (WPI), pertaining to the week ended March 3 and released on Friday, stood 6.46% higher than the same period last year. This same number had stood at 6.1% last week. For a while, the inflation numbers showed signs of responding to various government stimuli, but only for a short while. The WPI curve seems to have resumed its upward trajectory now. Like previous weeks, this time the u p w a r d nudge to the p r i c e - l i n e came from farm products such as vegetables. Cement also pitched in this week. Stagnant foodgrains production over a period of time has been the main reason for the current overwhelming problem of inflation. Despite a robust 6% agricultural growth during 2005-06, prices of foodgrains shot up nearly 11-13% this year. This clearly indicates that the inflation problem is not incipient, or something that’s a by-product of this year’s economic problems, but has been simmering below the surface for years. We enjoyed the spill-over effects of the Green Revolution (which took place in 1970’s) till last decade. India became the world’s second largest wheat and paddy producer and third largest pulses producer. The country was able to meet its domestic demand for foodgrains. But, the agriculture sector hardly found any place in the government’s agenda for the new growth era, in which the Indian economy has surfed along on the strong growth wave powered by industry and service sector, despite the wide fluctuations in the agriculture sector. The economic non-viability of farming, an unduly large dependence on weather (making it a very risky business with a low level of rewards), failure of price mechanisms, lower productivity and absence of marketing techniques for agriculture commodities led to a dismal situation in the sector. The area under the crop witnessed a decline in past five years with the yield per hectare going down. As a result, foodgrains output fell by 1.4% (CAGR) during 2001-05, reducing the net availability of foodgrains per individual. The Economic Survey of 2006-07, while admitting the farm sector’s depressing performance, stated that the low level of public investment, exhaustion of the potential of new high yielding varieties of wheat and rice, unbalanced fertiliser use, low seeds replacement rate, an inadequate incentive system and low post-harvest value addition were contributing to lacklustre agricultural growth during the new millennium. What’s astounding is the fact that the government knows very well what the problems are, but lacks the political will to address these issues. The sector cont r i b u t e s around 17-18% of GDP, but a mere 1% of the total expenditure incurred by all central ministries is spent on the sector. If you break down even this minuscule amount, only small change was spent on capital building, agriculture research and education. Similarly, hardly any medium or long term irrigation projects were undertaken in past few years when the proportion of irrigated land to cultivated land is only 40%. Despite the large number of schemes announced and the incentives doled out, there is still no appropriate credit system which can address the real needs of poor farmers. The government has announced few schemes addressing these issues in the latest budget for 2007-08. Also, budgetary resources were increased 13% for the coming year. Large-scale, bold pre-emptive measures are required before the mismatch in demand and supply of foodgrains becomes a regular phenomenon and India turns into a regular importer of foodgrains. And, when that does happen, it’s likely to bring in its wake a fresh set of problems. Apart from the uncertainty it will create for more than 60% of the population which is still dependent on the agriculture sector, imports will also impose additional pressure on agri-commodity prices in the international market, ultimately leading to import of inflation.

Courtesy: EconomicTimes

For more detail on Retail India visit: http://www.retailindia.tv/

No comments:

Post a Comment